The current status of the smart home market

Slowing demand for smart home products has impacted the technology Consumer goods (TCG) market. Consumer demand, which had fallen from the peak of the epidemic, has fallen again under the influence of the Russia-Ukraine conflict that broke out last year。

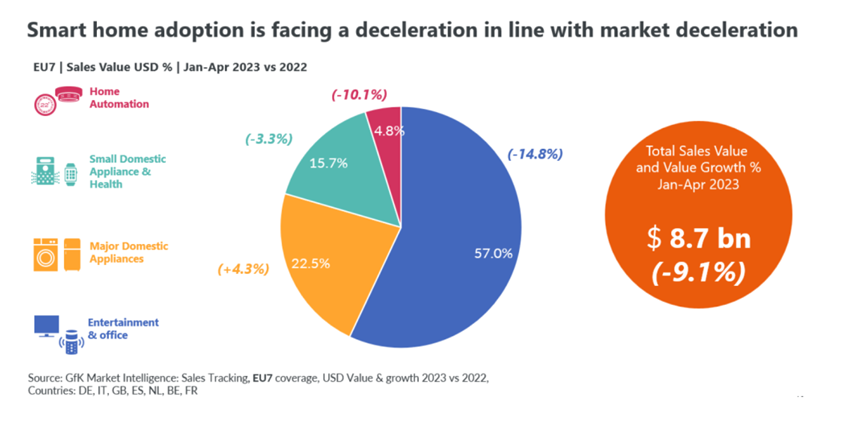

Demand for smart home products continued to slow in the first quarter of 2023, which is consistent with the trend in the overall TCG market. From January to April, sales of smart products in 11 major markets in the Asia-Pacific region (mainland China, Taiwan, India, Australia, Japan, Singapore, South Korea, Malaysia, Thailand, Vietnam and Indonesia) reached 18.3 billion US dollars, down 11% year-on-year. In the main European market, while the mainstream category of home appliances performed well, with sales up 4.3% year-on-year, sales of smart products in the first quarter ($8.7 billion) fell 9.1% year-on-year.

In 2020 and 2021, due to the impact of the epidemic, consumer demand for smart products has surged, and the price of smart products in major European markets has increased significantly; In 2022, under the pressure of the cost of living, demand fell, and the price of smart products also fell. In addition, the degree of commercialization of various smart products has increased, which has also led to a decline in the price of smart products with innovative features. By April 2023, the price of smart products had fallen by 14% in a year, returning to pre-pandemic levels.

Despite the lackluster performance, the overall revenue of the TCG market is still higher than in 2019. Intelligence is still one of the best means of high-end products. The world economy has shown signs of a shock recovery, coupled with the three major highlights of smart products with high performance, simplicity and high-end, consumer demand is expected to pick up by the end of 2023, but smart products still need to work hard to break into the mass market.

Current user population

The smart home market leader is the United Kingdom, where 26% of Internet users aged 16-64 own a smart home device. Italians, Spaniards and Chinese are also keen users of smart home devices, with more than one in five Internet users in these countries owning at least one smart home device.

Consumers in these countries are highly aware of smart homes. In the UK, four out of five consumers have some understanding of smart home concepts (up from three out of five in 2016). More than a third of consumers believe they are very knowledgeable about smart home products.

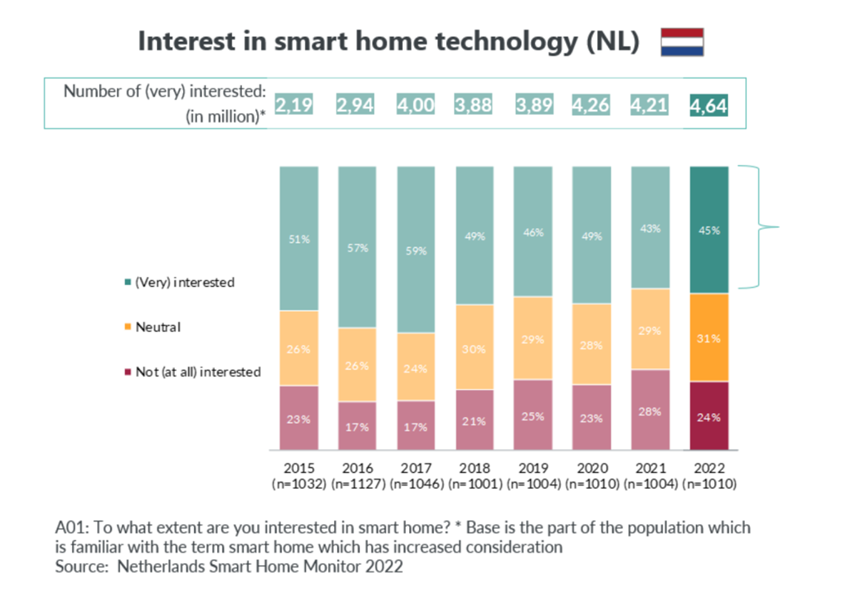

The penetration rate of smart home products in the Netherlands is also higher than the global average. According to the GfK Netherlands Smart Home Study, the number of people familiar with and interested in this field has more than doubled in seven years to 4.6 million. Dutch smart product enthusiasts are mostly highly educated men, between the ages of 18 and 34, and have higher than average incomes. But that group accounts for just over half of the overall population interested in smart homes.

An untapped market

In Thailand and Japan, less than 5 percent of Internet users aged 16-64 own a smart device. In Saudi Arabia, the Philippines, Indonesia, Argentina and South Africa, the figure is also less than 10 per cent.

About a fifth of global respondents said that the reason for not buying related products is not enough knowledge about smart homes. Therefore, ignorance, distrust, and cost issues may be the main reasons for the low penetration of smart products in these countries.

Even in leading regional markets, a large portion of the potential consumer base is skeptical of smart products. In the Netherlands, for example, the awareness of smart products and their advantages among tech enthusiasts has gradually increased since 2015, and the number of smart home product enthusiasts has doubled. However, the percentage of consumers who are familiar with smart products but not interested has remained relatively stable over the past seven years, with 24% in 2022.

Consumer barriers to purchase

The three barriers to smart home adoption are the same as GfK’s findings from last year’s study, but consumers’ hesitancies have begun to ease.

1

Price

43% of global respondents agree that price is still the biggest barrier to smart home adoption, even among better-off consumers. This is the case in 22 of the world’s 25 core economies. The decline of three percentage points since 2020 is due to the depreciation of the value of innovations over time and the recent decline in prices due to reduced demand in the TCG market.

More than half of the global respondents said they are not willing to pay more for smart home products than the standard version, but at the same time, more than 44% of consumers accept a premium for smart products, and this proportion is gradually increasing.

2

Privacy issue

In 2020, more than half of consumers worldwide are concerned that smart home products will lead to privacy breaches, and 63 percent are concerned about personal information being misused. In our latest survey, the percentage of respondents who are concerned about privacy breaches has fallen to 31%, and another quarter have security concerns. With reports of hackers hacking into home security cameras and smart voice assistants and eavesdropping on home conversations to gain access to user data, privacy concerns have become a top pain point for smart voice assistants. Therefore, brands need to continue to improve their privacy safeguards, which will go a long way to winning the trust and support of skeptics.

3

Unattractive

For many consumers, the reasons for choosing smart home products are still weak.

In developed regions of Asia, North America and Western Europe, consumer apathy towards smart home products is particularly prominent. In the UK, 42 percent of respondents said they don’t know enough about smart home technology to make a purchase. In contrast, consumers in emerging markets are more willing to experiment because they are mostly young and willing to experiment with innovative technologies.

Certain smart home products are also significantly less attractive, for example, 32 percent of global respondents believe that smart blinds and shades do not make sense.

How to win more potential customers

In order to surpass traditional home products, smart home products must break into the mass market, focusing on the five needs of global smart product buyers in 2023.

1

Convenient and practical

Utility is key for smart home products to win the mass market, with 41% of respondents accepting a premium for the convenience of life.

The smart robot vacuum cleaner is the most typical example, despite its average price ($423) being almost four times that of a regular robot vacuum cleaner ($116), it has managed to break into the mass market. Intelligent sweeping robots have a high penetration rate and currently account for about 87% of the products sold in the market.

Similarly, smart flat-screen TVS, thermostats, intruder security systems and visual cameras have now become mass consumer goods, and consumers have gradually realized the advantages of smart access control systems, smart cameras and dishwashers.

If consumers do not understand a product, its features no matter how convenient. Therefore, brands need to use a variety of media promotion to attract mass attention, such as news feeds, technology magazines, vlogs and blogs, influencers or live channels.

At the same time, political events also have an impact on product markets. For example, after the outbreak of the conflict between Russia and Ukraine, sales of smart security products surged by 10%; After the rise in energy prices, the purchase of smart thermostats also rose sharply.

2

Secure and reliable

While privacy concerns have diminished over the past three years, the TCG industry still has a long way to go in building trust in the smart home. To reassure consumers, the product’s security and data protection features must be clearly defined.

The penetration of smart home products in Japan is extremely low, and local regulators recently warned the developers of the artificial intelligence ChatGPT not to collect sensitive data without users’ permission. Ai will drive many new capabilities, including pattern recognition, general Settings, and early warning maintenance alerts. Therefore, in the marketplace, increasing user engagement and transparency of product information is very important (and sometimes even mandatory), and can bring huge returns.

Brands can increase trust in their products by answering frequently asked questions, such as explaining how they protect personal data and prevent cyberattacks.

3

Compatibility

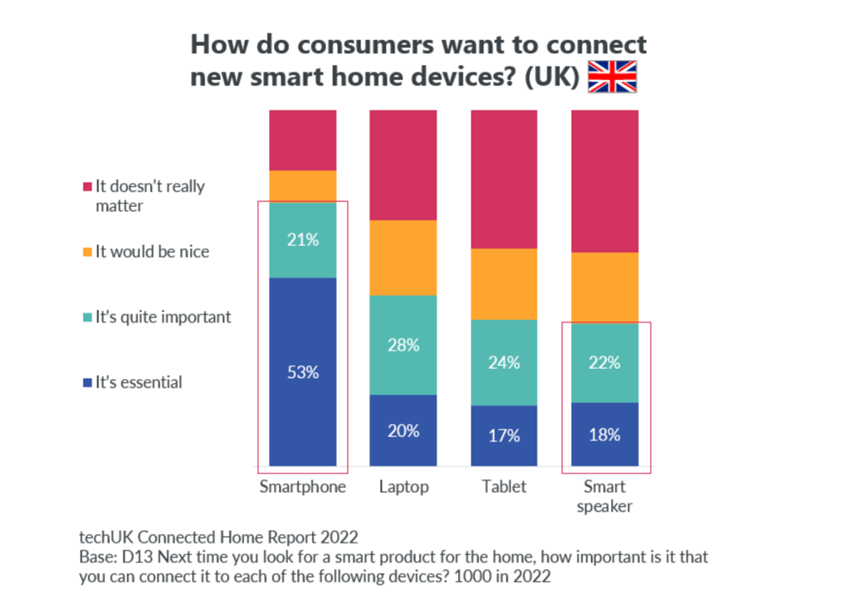

Compatibility issues are also a major concern for consumers, with 18 percent of consumers concerned that technologies from different systems may not be compatible with each other. Brands need to shorten the learning curve so that users can easily set up multiple devices and recover quickly in the event of an update error or a broken connection.

Matter, an open source standards project for the smart home, is making progress in this area by leveraging existing technology stacks such as threading, Wi-Fi, Bluetooth, and Ethernet to enable different brands of smart devices to communicate with each other. Dozens of major brands have pledged their support for the new standard, which will break down one of the biggest barriers to mass adoption of smart homes. But its adoption has been rather slow since its release.

Smartphone connectivity is also clearly a consumer priority, with three quarters of UK users rating it as important.

4

Innovation and high performance

Smart connectivity is one of the reasons for the higher price of smart home products, but in a volatile economic environment, even consumers with a budget will be wary of high prices. Brands need to work harder to demonstrate the long-term value of smart home products, such as the above high performance, innovative features that can add convenience to consumers’ lives, or provide superior experiences, or save consumers money and time in the long run (such as energy saving features).

The correlation between smart functions and sustainability is also growing. In fact, smart features are driving sustainability, making the sustainability of tech consumer goods measurable, and the definition of a good product is expanding from mere performance characteristics to sustainability characteristics. At major consumer shows such as IFA and CES, there is a growing trend for brands to help consumers understand and reduce their energy consumption by optimizing product energy efficiency.

At the same time, smart vacuum cleaners are also continuing to develop, from January to May 2023, the growth rate of the new dry and wet dual-use base station type washing machine reached three digits, while the dry suction vacuum cleaner only increased slightly.

conclusion

Smart home technology has great development potential, and its products have obvious practical advantages compared with conventional products. To win over more potential consumers, manufacturers and retailers need to position their products in the affordable high-end product range, build trust by increasing transparency, and prove the benefits of smart home products to consumers.